“Barter Exchange: A Traditional System of Exchange”

Barter system is a system that was used in ancient times to exchange goods. In Other words, this system was used to exchange one commodity for another before the monetary system came into existence. For example, if a person having rice wants tea, then he can exchange rice with a person who has tea and needs rice.

Limitations/Drawbacks of Barter Exchange system

The various drawbacks of the barter system are as follows:

1. Problem of double coincidence of wants

Double coincidence of wants implies that needs of two individuals should complement each other for the exchange to take place. For example, in the above case, the second person must need rice in exchange for tea.

2. Lack of common unit of value

Under the barter system there was no common unit for measuring the value of one good in terms of the other good for the purpose of exchange. For example, a horse cannot be measured in terms of rice in the case of exchange between rice and horse.

3. Difficulty in wealth storage

It was very difficult to store commodities for future exchange purposes. The perishable goods like grains, milk and meat could not be stored to exchange goods in future. Therefore, wealth storage was a major difficulty of the barter system.

4. Lack of standard of deferred payments

The future payments could not be met in a C-C economy (barter system) as wealth could not be stored. It was very difficult to pay back loans.

MEANING OF MONEY:

Money is anything which is generally accepted as medium of

exchange, measure of value, store of value and as means of standard of deferred payment.

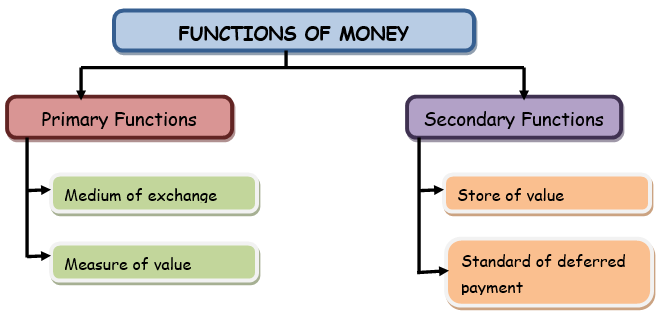

FUNCTIONS OF MONEY: Functions of money can be classified into Primary and Secondary

Primary/Basic functions:

i) Medium of Exchange: – It can be used in making payments for all transactions of

goods and services.

ii) Measure /Unit of value: – It helps in measuring the value of goods and services. The

value is usually called as price. After knowing the value of goods in single unit

(price) exchanges become easy.

Secondary functions:

i) Standard of deferred payments: Deferred payments referred to those payments which

are to be made in near future. Money acts as a standard deferred payment due to the following reasons:

a) Value of money remains more or less constant compared to other

commodities.

b) Money has the merit of general acceptability.

c) Money is more durable compare to other commodity.

ii) Store of value: Money can be stored and does not lose value

Money acts as a store of value due to the following reasons:

a) It is easy and economical to store.

b) Money has the merit of general acceptability.

c) Value of money remains relatively constant

TYPES OF MONEY

- Legal Tender Money: Money which can be legally used to make payments for some obliged debt is known as legal tender money. It is of two types-

- Limited legal tender money: It is that form of legal money which is used to make payments for the debts up to a certain amount. For example; coins.

- Limited legal tender money: It is that form of legal money which is used to make payments for the debts up to a certain amount. For example; coins.

- Unlimited legal tender money: It is that form of legal money which can be used to make payment of debts up to any amount. There is no limit fixed. For example; paper/ currency notes.

- Full Bodied Money: It is that form of money in which face value is equal to intrinsic value of money. It means commodity value= money value. For example: gold and silver coins.

- Representative Full Bodied Money: It is that form of full bodied money in which intrinsic value is less than face value of money. It means commodity value< money value. For example: paper notes.

- Credit Money: It is that form of money whose intrinsic value is lower than its face value. It means that money value> commodity value. For example: credit cards, bank deposits etc.

MONETARY SYSTEM IN INDIA

- In India, monetary authority is ‘Reserve Bank of India’.

- Paper currency standard is followed in India.

- Coins are regarded as limited legal tender money.

- RBI has sole monopoly to issue currency in India.

- Ministry of Finance issues 1 rupee coins and notes in India.

- India follows Minimum Reserve System for issuing notes. It means that RBI has to keep a minimum of Rs. 200 crores as gold and foreign exchange with the World Bank for issuing coins and notes.

MONEY SUPPLY

Money supply refers to the total money held by public at a particular point of time in an economy.

It includes money only held by the “public” not the government or banking system. Money supply is a “Stock” concept.

There are 4 measures of money supply. As per money and banking class 12 we need to cover only M1 measure of money supply.

MEASURES OF MONEY SUPPLY

(i) M1: It is the first and basic measure of money supply. It includes currency held by the public, demand deposits of commercial banks and other deposits with the RBI.

M1= Currency and coins with public+ Demand deposits with commercial banks+ Other deposits with RBI

(ii) M2: It also includes savings deposits with the post office saving bank.

M2 = M1 + Savings deposit with Post office saving bank

(iii) M3: It is a broader concept, it also includes net time deposits in addition to M1 measure of money supply.

M3 = M1 + Net time deposits with banks

(iv) M4: It includes total deposits with post office savings bank in addition to M3 measure of money supply.

M4 = M3 + Total deposits with post office saving bank

- M1 is the most liquid form of money supply while M4 is the least liquid.

- M1 and M2 are considered the narrow concept of money supply while M3 and M4 are the broader concept of money supply.

HIGH POWERED MONEY

- High powered money is the money produced by RBI and the government.

- It includes currency held by the public and the cash reserves held by the banks.

- It is denoted by symbol (H).

- It is different from money because money consists of demand deposits while it includes cash reserves which act as a base for generating demand deposits.

Commercial Bank

A commercial bank is a bank which accepts deposits from the public and advance loans to the public for the purpose of earning profits. For example: SBI, PNB, Canara Bank, Kotak Mahindra Bank etc.

Functions of commercial Banks

Primary Functions

- Accepting Deposits – Commercial banks accept deposits from their customers in the form of saving, fixed, and current deposits.

- Savings Deposits – Savings deposits allow a customer to credit funds towards their accounts for up to a certain limit. These deposits are preferred by individuals with a fixed income, utilized to create savings over time.

- Fixed Deposits – Fixed deposits come with a predetermined lock-in period. Fixed deposits are also referred to as time deposits as the funds are deposited for a specific time frame.

- Current Deposits – Current deposits allow account holders to deposit and withdraw money whenever necessary. In some cases, current accounts also offer overdrafts until a pre-specified limit to individuals and businesses.

- Providing Loans – One of the main functions of commercial banks is providing credit to organizations and individuals, and profit from the earned interest. Usually, banks retain a small reserve for their expenses while offering the remaining amount to customers as various types of short and long-term credits.

- Credit Creation – A unique function of commercial banks is credit creation. Instead of offering liquid cash, banks create a line of credit and transfer the loan to a business or commercial body all at once.

Categories of Secured and Unsecured Loans provided by Commercial Banks

- Cash Credit – Commercial Banks and their Functions include extending advances to individuals and organizations against bonds, inventories, and other types of securities. This facility, commonly known as cash credit, provides a more substantial sum when compared to other forms of credit.

- Short-Term Credits – Short-term loans are usually pledged without any security, offering a smaller loan amount and repayment tenor. These are also referred to as personal loans.

Secondary Functions

The following can be considered as the secondary functions of commercial banks –

- Providing locker Facilities – Commercial banks provide locker facilities to customers who want to store valuables safely. Locker facilities eliminate the impending risk of theft or loss, which prevail when kept at home.

- Dealing in Foreign Exchange – Commercial banks help provide foreign exchange to individuals and organizations that export or import goods from overseas. However, only certain banks which have the license to deal in foreign exchange are eligible for such transactions.

- Exchange of Securities – Another function of commercial banks is to trade in bonds and securities. Customers can purchase or sell the units from the financial institution itself, which offers more convenience than alternate approaches.

- Discounting Bills of Exchange – The main function of a commercial bank in today’s date is to discount bills of businesses. Bill discounting is considered a profitable investment for banks. Bills create a steady flow of funds, while not becoming a risky venture during payment as it is considered as a negotiable instrument. These also do not involve the financial institution in any litigation.

- Bank as an Agent – Commercial Bank and its Function also require them to provide finance-related services to customers, fulfilling the role of an agent. These services usually include –

- Acting as an administrator, trustee, or executor of a customer-owned estate.

- Assisting customers with tax returns, tax refunds, and other similar tasks.

- Serving as a platform to pay premiums, repay loan installments, etc.

- Offering a platform for electronic transaction of funds, processing of cheques, drafts, bills, etc.

MONEY CREATION/DEPOSIT CREATION/CREDIT CREATION BY COMMERCIAL

BANK

Let us understand the process of credit creation with the following example.

Suppose there is an initial deposit of Rs. 1000 and L.R.R. is 20% i.e., the banks have to keep

Rs. 200 and lend Rs. 800/-. All the transactions are routed through banks. The borrower

withdraws his Rs. 800/- for making payments which are routed through banks in the form of

deposits account.

The Bank receives Rs. 800/- as deposit and keeps 20% of Rs.800/- i.e., Rs.160/- and lends

Rs.640/, Again the borrower uses this for payment which flows back into the banks thereby

increasing the flow of deposits.

| Deposits (in Rs.) | Cash Reserve Ratio (20%) | Loans | |

| Initial deposit (Primary Deposit) | 1000 | 200 | 800 |

| Derivative deposits First round | 800 | 160 | 640 |

| second round | 640 | 128 | 512 |

| – | – | – | |

| – | – | – | |

| – | – | – | |

| Total | 50000 | 1000 | 4000 |

MONEY MULTIPLIER:

Money Multiplier = 1/LRR. In the above example LRR is 20% i.e., 0.2, so money multiplier

is equal to 1/0.2=5.

Why only a fraction of deposits is kept as Cash Reserve?

a) All depositors do not withdraw the money at the same time.

b) There is constant flow of new deposits into the banks.

CENTRAL BANK

Central bank is the ‘apex’ body that controls, regulates and operates the entire banking system in the country. In India, the central bank is RBI

FUNCTIONS OF CENTRAL BANK:

i) Currency authority or bank of issue: Central bank is a sole authority to issue currency in

the country. Central Bank is obliged to back the currency with assets of equal value

(usually gold coins, gold bullions, foreign securities etc.,)

Advantages of sole authority of note issue:

a) Uniformity in note circulation

b) Better supervision and control

c) It is easy to control credit

d) Ensures public faith

e) Stabilization of internal and external value of currency

ii) Banker to the Government: As a banker it carries out all banking business of the

Government and maintains current account for keeping cash balances of the government.

Accepts receipts and makes payments for the government. It also gives loans and

Advances to the government.

iii) Banker’s bank and supervisor: Acts as a banker to other banks in the country—

iv) Custodian of cash reserves: Commercial banks must keep a certain proportion

of cash reserves with the central bank (CRR)

v) Lender of last resort: When commercial banks fail to need their financial

requirements from other sources, they approach Central Bank which gives loans

and advances.

vi) Clearing house: Since the Central Bank holds the cash reserves of commercial

banks it is easier and more convenient to act as clearing house of commercial

banks.

vii) Controller of money supply and credit: Central Bank or RBI plays an important role

during the times of economic fluctuations. It influences the money supply through

quantitative and qualitative instruments. Former refers to the volume of credit and the

latter refers to regulate the direction of credit.

v) Custodian of foreign exchange reserves: Another important function of Central Bank is the custodian of foreign exchange reserves. Central Bank acts as custodian of country’s stock of gold and foreign exchange

reserves. It helps in stabilizing the external value of money and maintaining favorable

balance of payments in the economy.

Control of Credit:

The chief objective of the central bank is to maintain price and economic stability

QUANTITATIVE INSTRUMENTS: The quantitative instruments are also known as general tools used by the RBI (Reserve Bank of India). As the name suggests, these instruments are related to the quantity and volume of the money. These instruments are designed to control the total volume/money of the bank credit in the economy. These instruments are indirect in their nature and are used to influence the quantity of credit in the economy.

i) Bank Rate policy: It refers to the rate at which the central bank lends money to

commercial banks as a lender of the last resort. Central Bank increases the bank rate during inflation (excess demand) and reduces the same in times of deflation (deficient demand)

ii) Open Market Operations: It refers to the buying and selling of securities by the

Central Bank from/ to the public and commercial banks.

It sells government securities during inflation/excess demand and buys the

securities during deflation/deficient demand.

iii) Legal Reserve Ratio: R.B.I. can influence the credit creation power of commercial

banks by making changes in CRR and SLR

Cash Reserve Ratio (CRR): It refers to the minimum percentage of net demand

and time liabilities to be kept by commercial banks with central bank.

Reserve Bank increases CRR during inflation and decreases the same during

deflation

Statutory Liquidity Ratio (SLR): It refers to minimum percentage of net demand

and time liabilities which commercial banks required to maintain with themselves.

SLR is increased during inflation or excess demand and decreased during

deflation or deficient demand.

iv) Repo Rate

A Repo Rate is a rate at which commercial banks borrow money by selling their securities to the RBI to maintain liquidity. Commercial banks sell their securities in case of a shortage of funds or due to some statutory measures. It is one of the main instruments of the RBI that keeps inflation under control.

v. Reverse Repo Rate

Sometimes, the RBI borrows money from commercial banks when there is excess liquidity in the market. In that case, commercial banks get benefits by receiving the interest on their holdings with the RBI. At times of higher inflation in the country, the RBI increases the reverse repo rate, which encourages banks to park more funds with the RBI, which will help it earn higher returns on excess funds.

QUALITATIVE INSTRUMENTS:

- Margin Requirements: It is the difference between the amount of loan and market

value of the security offered by the borrower against the loan.

Margin requirements are increased during inflation and decreased during deflation. - Moral suasion: It is a combination of persuasion and pressure that Central Bank

applies on other banks in order to get them act in a manner in line with its policy. - Selective credit controls: Central Bank gives direction to other banks to give or not to

give credit for certain purposes to particular sectors